Money laundering is a serious crime that can have huge consequences for businesses and individuals.

Despite this, money laundering continues to be a problem around the world. Here are some Money Laundering Statistics to help you understand the scope of the issue.

On this page, you are about the latest statistical data on money laundering and how it is still a global issue.

Key Finding on Money Laundering Statistics

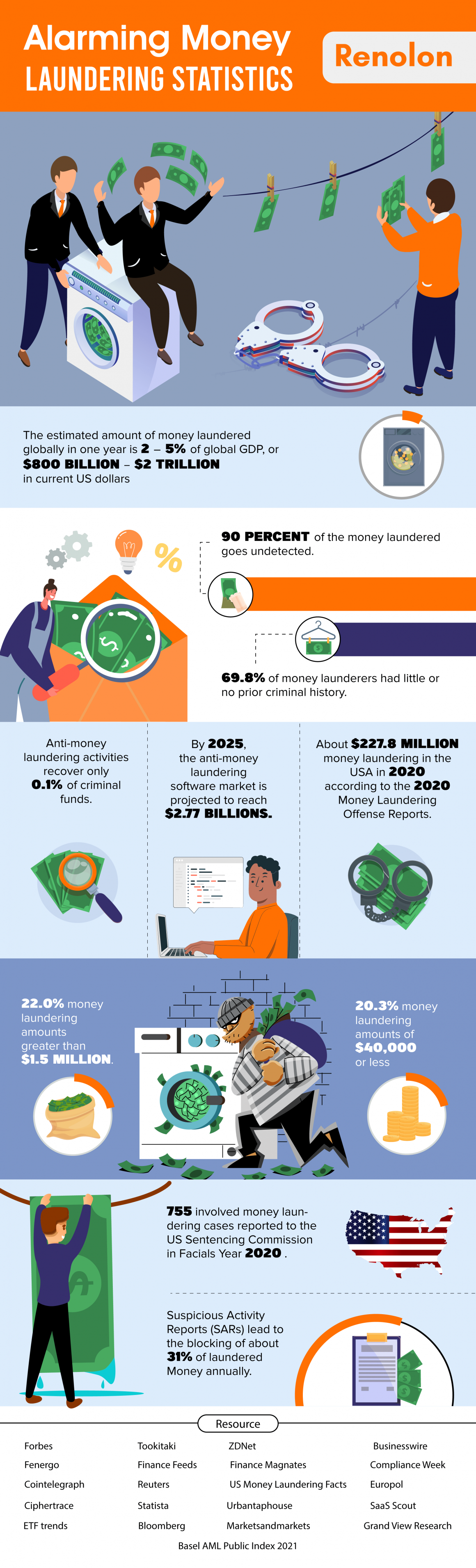

- About $227.8 million money laundering in USA in 2020 according to our calculation that based 2020 Money Laundering Offense Report (Total estimate amount to be $300 Billion each year).

- 22.0% money laundering amounts greater than $1.5 million.

- 20.3% money laundering amounts of $40,000 or less.

- The median money laundering amounts was $301,606.

- 755 involved money laundering cases reported to US Sentencing Commission in Facials Year 2020 .

- The estimated amount of money laundered globally in one year is 2 – 5% of global GDP, or $800 billion – $2 trillion in current US dollars.

- By 2025, anti-money laundering software market is projected to reach $2.77 billion.

- Anti-money laundering activities recover only 0.1% of criminal funds.

- 70.6% money laundering offenders were United States citizens.

- 69.8% money launder had little or no prior criminal history.

- 90 percent of the money laundered goes undetected. (Source: Forbes)

- Suspicious Activity Reports (SARs) lead to the blocking of about 31% of laundered Money annually.

U.S Money Laundering Statistics 2020

- 755 involved money laundering cases reported to US Sentencing Commission in Facials Year 2020.

- About $227.8 million money laundering in USA in 2020

Money Laundering Punishments Stats

- 64 months is the average sentence for money laundering offenders.

- 87.7% of were sentenced to prison.

- 31.3% were convicted of an offense carrying a mandatory minimum penalty

- The average age of these offenders at sentencing was 42 years.

Global Money Laundering Statistics 2021

- The estimated amount of money laundered globally in one year is 2 – 5% of global GDP, or $800 billion – $2 trillion in current US dollars.

- The average global money laundering risk score increased from 5.22 to 5.3 out of 10 (Reported by Basel AML Public Index 2021)

- 50% money laundering goes undetected across the industry as a whole.

- 62% compliance officers say criminal activity is getting harder to spot. (Basel System Reports 2021)

How Much Money is Laundered Every Year

According to estimates by UN Reports, the figure is around $800 billion to $2 trillion globally. In the United States, it’s estimated that around $300 billion is laundered each year.

How Much Money is Laundered Globally Each Year

The global volume of money laundering is estimated between $800 billion and $2 trillion laundered globally each year.

This money comes from a variety of illegal activities, such as drug trafficking, human trafficking, weapons trafficking, and corruption. Laundering this money is essential for criminal organizations to keep their activities hidden and to enjoy the benefits of their ill-gotten gains.

AML Software Market Size

- By 2025, anti-money laundering software market is projected to reach $2.77 billion.

- In 2019, AML noncompliant banks paid 6.2 billion USD fines globally.

Money laundering is a danger to not just the global economy, but also to national security. It jeopardizes financial institutions’ profitability because to the costs associated with combating the vice via higher anti-money laundering expenditures, such as the purchase of anti-money laundering software. Additionally, nations suffer additional costs in implementing anti-money laundering legislation. Financial institutions’ SARs assist authorities in intercepting money laundering.

Financial institutions and Money Laundering Statistics

Banks and other financial institutions are used by criminals to launder their ill-gotten gains. Banking institutions are preferred money laundering tools for criminals because they offer a variety of financial services, including foreign exchange, deposits, cash transfers, and loans.

Additionally, it is simple to utilize these institutions to move assets or cash to branches or other institutions located in other geographical areas with favorable or lenient money laundering laws.

The established global economy and interconnected money markets have made foreign money transfers simple, quick, and convenient. In certain nations, strict bank secrecy rules aid in concealing the source of illicit money, making it simpler for criminals to launder money.

1. From 2008 to 2017, financial institutions lost about $321 billion globally through fines for being non-compliant to standardized regulations, assuaging laundering of money, funding terrorism, and manipulating the market.

(Source: Bloomberg)

Banks suffered significant losses between 2008 and 2017 as a result of their failure to comply with laws designed to combat financial crime. Not only do the financial institutions in issue enable money laundering, but they also assist criminals in funding terrorists and manipulating the market in their advantage. Banks commit this offense by failing to follow AML transaction rules and by neglecting to provide appropriate authorities with SARs.

2. Financial institutions paid penalties worth $8.4 billion globally in 2019 compared to $4.27 billion in 2018 for breaching AML regulations.

(Source: Accountability Daily)

In 2019, the value of penalties paid by noncompliant AML institutions almost doubled that of fines paid in 2018. Additionally, the number of AML non-compliance fines doubled in 2019, from 29 in 2018 to 58 in 2019. This demonstrates an increase in financial institutions’ carelessness regarding the submission of SARs and the implementation of measures aimed at combating financial crime.

3. Of all the 2019 AML fines, the US served 25 penalties worth $2.29 billion compared to 12 penalties worth $388.4 million.

(Source: Accountability Daily)

American authorities were the best in the world in policing money laundering and other financial crimes, having imposed almost half of all global penalties, followed by the UK. France, on the other hand, faced the highest penalty, totaling $5.1 billion. The average fine in 2019 was 145.33 million dollars.

4. By the end of 2020, AML related fines and penalties rose to $10.4 billion globally.

(Source: Compliance Week)

Fines and penalties levied on financial institutions that violate anti-money laundering laws will have risen by $2 billion by the end of 2020. Over the period 2008 to 2020, banking institutions paid a total of 46.4 billion USD in AML-related penalties across the globe. This is an indicator of financial institutions’ failure to comply with anti-money-laundering (AML) laws. Inattention to detail such as this undermines the work of the relevant authorities to combat money laundering.

5. The Asia Pacific region issued a total of $5.1 billion while the US issued $4.3 billion in total fines in 2020.

(Source: Compliance Week)

In terms of AML fines issued in 2020, the Asia Pacific area was ahead of the United States. In third place was Malaysia, which received $3.9 billion in fines, followed by Australia, which received 921.5 million USD in fines, Sweden, which received 550 million USD, and the United Kingdom, which received 199 million USD in fines. Regulators from these nations performed the best in the world in 2020 when it came to implementing money-related criminal laws.

6. In January and February 2021 the Federal regulators served AML penalties above $200 million to AML non-compliant financial organizations.

(Source: Finance Feeds)

This pattern is indicative of a record rise in the fines levied against financial institutions for failing to comply with anti-money laundering rules and legislation. In addition, there has been an increase in the assessment of AML compliance among financial institutions, as well as the passage of the Bank Secrecy Act Obligations, which will likely result in a significant rise in the severity of penalties in 2021.

The AML Software Market

Money laundering techniques are always evolving, and as a result, authorities must create strong laws to fight this evil. Because of the pressure applied by both criminals and anti-money-laundering regulatory agencies, anti-money-laundering software has become a need for all financial institutions. According to these data, the high demand for this software has resulted in a significant increase in the market’s size.

7. By 2025 the global market of AML software growth will be worth 2717 million USD.

(Source: Tookitaki)

The value of AML software was just $879 million in 2014, but it is expected to increase by more than 300 percent by 2025, according to forecasts. This rise is related to an increase in demand for anti-money-laundering software by financial institutions in order to more effectively identify money-laundering operations.

8. Between the years 2020 and 2025, the software market for AML is predicted to attain a CAGR of 14.12%.

(Source: Businesswire)

Because of the increasing need for software across the world, this represents a trend of continuing expansion year after year. Many financial service companies would consider increasing their investment in anti-money laundering software in order to be AML compliant.

9. In 2019 the market for AML software share for North America was 36.4% of the world market.

(Source: Businesswire)

North American dominated the AML software market in 2019 probably because regulators in that region were the best in dealing with financial crimes.

Amount of Money Laundered Globally

The estimated amount of money laundered globally in one year is 2 – 5% of global GDP, or $800 billion – $2 trillion in current US dollars

Final Thoughts

Money laundering has ramifications not just for the economy, but also for global security and the forces of the market. This is due to the fact that illicit money is used to finance criminal acts such as terrorism, as well as to manipulate the stock market and currency markets. Criminals launder a significant amount of money each year via the use of financial institutions that fail to adhere to anti-money laundering laws and guidelines.

These rules are enforced by regulators, who prosecute and sentence non-compliant financial institutions and people who violate them. After being found guilty, the inmates are penalized severely in order to dissuade them from cooperating in money laundering in the future.

Cryptocurrencies and financial institutions both function as channels for illicit money laundering on the part of criminals. Similarly to financial institutions, criminals have used Bitcoin to launder billions of dollars in the United States since the cryptocurrency’s debut. All businesses that provide financial services should follow the anti-money laundering laws and legislation set in place by various countries to avoid money laundering.

Banks and other financial institutions may utilize Anti-Money Laundering Software to effectively identify and report any suspected illegal behavior to the appropriate authorities. The AML software industry is expanding at a rapid pace, and it is projected to continue to expand through 2025 at the current rate.

The development of more sophisticated techniques for money laundering, cybercrime and the introduction of large data analysis and storage solutions, the expansion of Know Your Customer (KYC) to verify user identities, and the enforcement of government regulations and legislation are all factors contributing to the market growth of AML software.

Drivers that propel the market growth of the AML software include; increased and sophisticated techniques used to launder money, cybercrimes, the advent of large data analyzing and storage solutions, the growth of KYC to verify user identities, and the enforcement of government regulations and laws

FAQs

How much money is laundered in the us?

In the US, it is estimated that 300 billion is laundered each year according to the Money Laundering Offense Report.

How much money is laundered in the uk each year ?

It is estimated that £36 billion to £90 billion is laundered in the United Kingdom each year according to the NCA.

Does money laundering still exist ?

Yes, money laundering still exists. Though various anti-money laundering measures have been put into place over the years, criminals continue to find ways to move dirty money around the world and conceal its origins.

Some of the most common methods used for money laundering include:

-Cash smuggling

-Structuring bank deposits or withdrawals to avoid reporting requirements

-Shell companies and offshore banks

-Money transfer services like Western Union or MoneyGram

-Fake invoices and other bogus transactions